How to apply for SSS Salary Loan Online 2021

Need immediate extra cash? If you're an SSS member and a regular contributor, then you're lucky! You can now apply for your loan from the comfort of your home via My.SSS. My.SSS portal. You just need to provide the documents and ensure that they satisfy the required requirements and you'll receive the loan money in no time.

One of the benefits that the Philippine Social Security System (SSS) provides includes that of the SSS salary loan. It is low-interest and unlike others. The amount you are able to borrow will be determined by your current contributions which means that the money you borrow is a portion of yours.

SSS Salary loan details

The eligibility requirements for applicants

SSS members that are eligible to receive a salary loan include the following:

- At least 36 consecutive months of contribution

- Are currently employed by the employer for a minimum of a year;

- Each month's contributions must be up-to-date;

- Isn't receiving the last benefit, like complete permanent disability or retirement or death;

- You must be younger than sixty-five (65) at the time of application;

- Is not disqualified for the fraud that was committed by SSS

NOTE: The amount of the loan will be determined in part on an SSS member's contribution total.

A one-month salary loan corresponds to the median of the borrower's most recent twelve Month Salary Credits (MSCs) or the amount they applied for, which is less. A two-month salary loan is equivalent to double the amount of the borrower's most recent 12 MSCs and rounded to the next month's higher salary credit or the amount requested, whichever is less. The amount net of the loan will be the amount that is the difference between the loan approved amount and the outstanding balance of short-term loans for members.

The Schedule of Payment

In accordance with SSS The loan must be paid off in 2 (2) years, in 24-month installments. The monthly amortization will begin in the 2nd month following when the loan was made due by the due date for payment. Refer to the image below as an illustration.

Payment must make payment at any near SSS branch, bank that is SSS-accredited or at a SSS-authorized center for payment.

Service Fee

A service charge in the amount of 1 (1) per cent of the amount of credit must be charged and subtracted from the profits from the loan.

Loan Renewal

SSS members are eligible to renew the loan upon payment of at least 50% of the principal amount, and 50% of the loan time has passed. Therefore, the proceeds of the renewal loan are any amount that is greater in value than provided that the outstanding amount of the loan is subtracted.

If the member-borrower changes his or her job, they must provide to the new employer a new statement of account for any outstanding loan balances with SSS and allow the employer to subtract from his/her salary the amortization amount due, which includes any interest or penalty for late payment. ( Source )

Continue reading to understand the step-by step procedure of how you can apply to apply for SSS pay loan.

SSS Salary loan online process

First Step: Login to My.SSS Portal through a browser

Go to https://www.sss.gov.ph/ and tick the box under the "I'm not a robot" pop-up.

2. Click the Member's Login

Click the 'Member' link to open the member's login page. After being directed, enter your My.SSS username and password. Be sure to tick"I'm not robot. "I'm not a bot" box prior to clicking the submit button.

If you've forgotten your password or user ID If you forget your password or user ID, just click the "Forgot password or user ID?" link under the "Submit" button. After clicking, you'll be taken to a webpage where you'll need to enter your username (if you've forgotten only the password) or your email address (if you've forgotten both your password and user ID). Enter 'Submit', and then check your email for any instructions from SSS on the retrieval and the reset process for your My.SSS login details for your account.

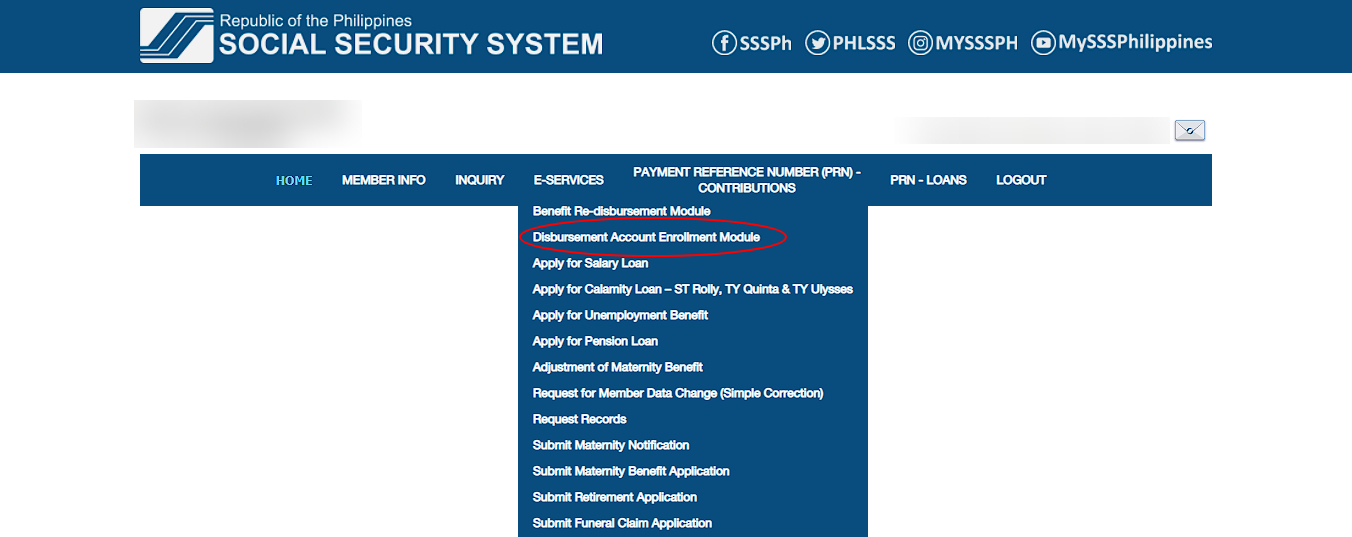

3. Choose E-Services

Within the navigation bar, look for E-Services and then click on the "Disbursement Accounts Enrollment Module" for people who haven't yet submitted any supporting documents or bank information . Note down the warnings prior to going ahead.

img source: WhatALife!

Important Reminders!

A. Details of the bank account and mobile numbers should be current active and in good standing. They are not included in the following:

- Closed Account

- dormat account

- Account name is different from member's name

- dollar account

- frozen account

- An incorrect bank account

- An invalid mobile number

- Accounts that are joint or in a combination

- Not an account that is already in existence

- different disbursing bank

- Prepaid account

- time deposit accound

- with some restrictions

- Multiple accounts/numbers are rejected.

B. Double-check the information you provide and that you fill all required fields with correct information.

C. The disbursement of loan proceeds will be done through PESONet participating banks

D. If there are errors in encoded/provided data or in the accounts are closed or invalid the re-crediting or re-disbursement of your benefits could require at minimum 30 (30) days for the process

E. The last but not the last, uploading proof of the account used for disbursement is required. Only approved accounts that have been verified and approved can be used to disburse benefit or loan funds through the SSS.

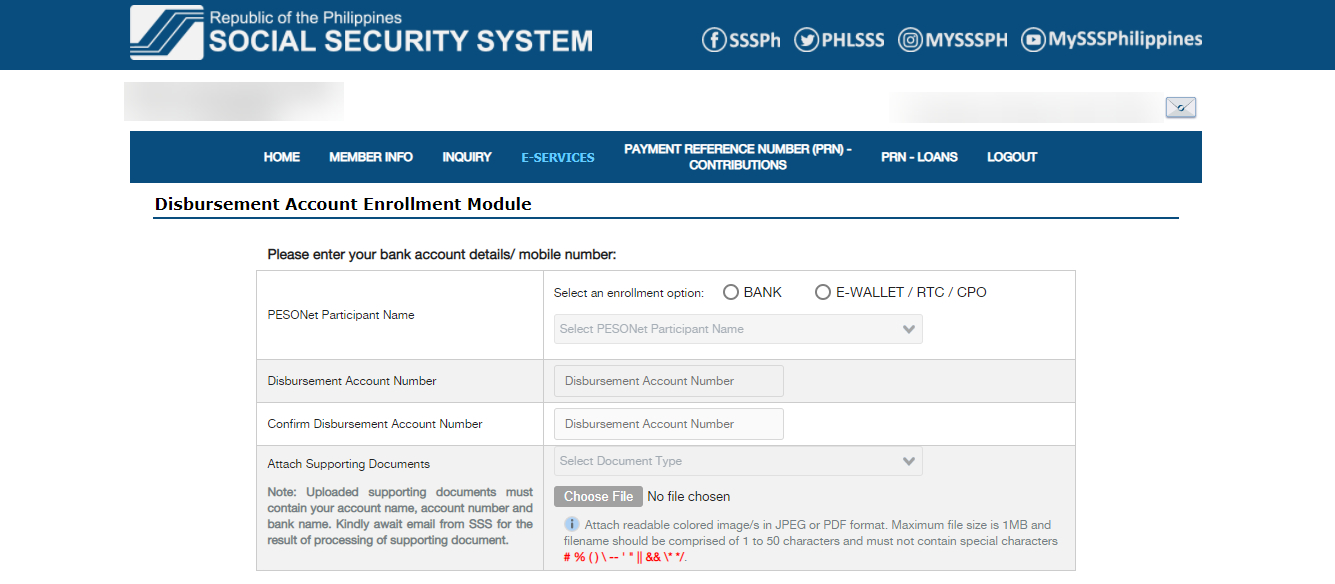

Step 4: Provide Bank Details

Give the bank account number or the mobile number of the account on which you wish to deposit your cash. Note: Attached files must not exceed 1MB. Therefore, ensure that you compress documents and then resize them with apps available on mobile apps as well as desktop applications (.zip)

img source: WhatALife!

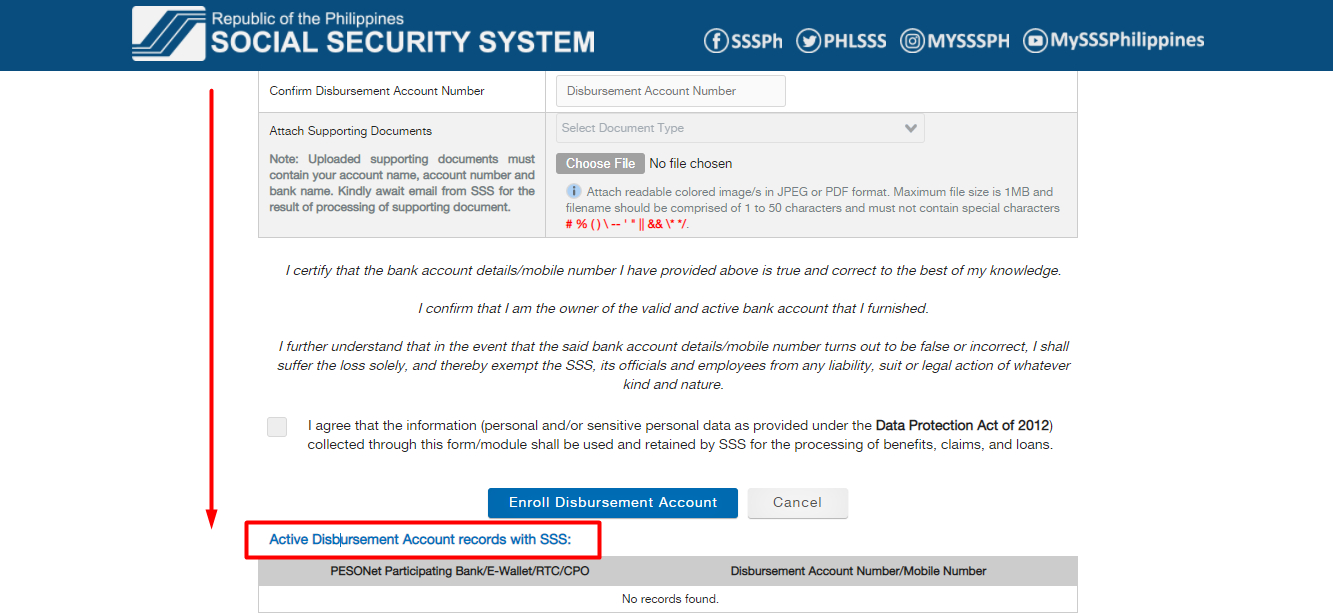

Step 5: Wait for SSS approval

You should wait a few days for SSS approbation of your bank or E-wallet. After approval, you can start to fill out the SSS salary application for a loan.

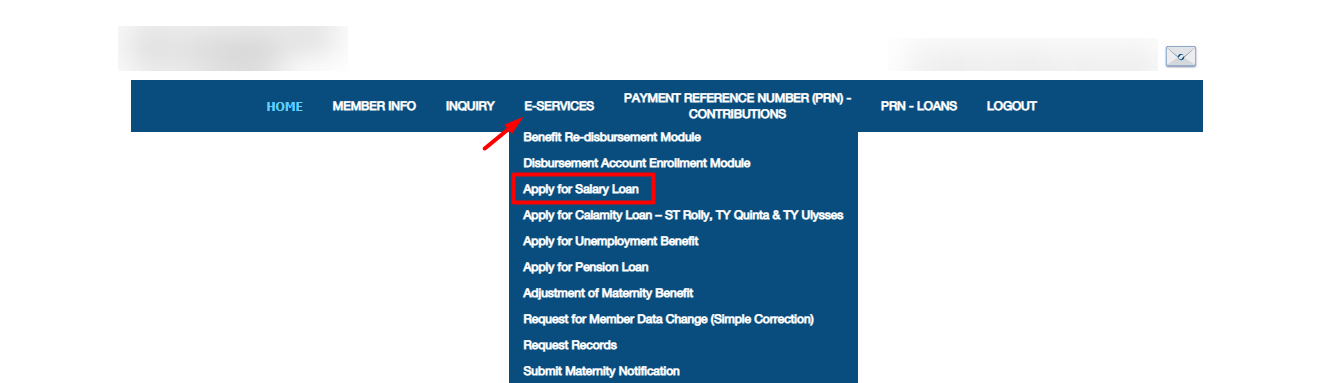

6. Click Apply for a Salary Loan

img source: WhatALife!

On the menu bar, look for E-Services and then select Apply on behalf of Salary Loan (or different types of loans you'd like to apply for) to begin.

You'll be able to see your loanable amount in the available amount, which you can choose your preferred bank. Scroll down to read the reminders for the member before clicking the "I accept terms and conditions box". Click "Proceed". Keep track of the payment terms for the month and the due date.

7. Read your Application

Examine your application prior to pressing the submit button. Keep track of the transaction number to be used for future queries.

After a few days After a few days, you will get the Salary loan funds through the bank you prefer.

If you have any questions or concerns, make contact with the SSS hotline 1455/Toll-Free No. 1-800-10-2255777 / SSS email at member_relations@sss.gov.ph