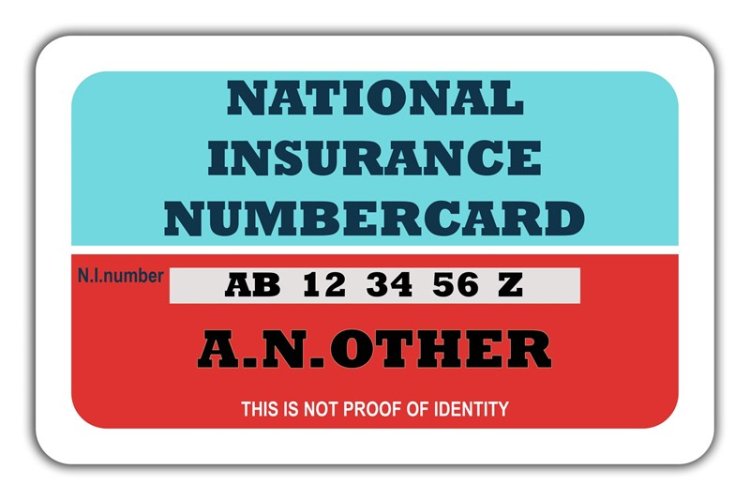

What does my National Insurance table letter mean?

This table letter informs employers how much National Insurance a person needs to contribute. To allow umbrella employers to manage their payroll, they must calculate the National Insurance they and you need to contribute. They use a table letter to do this.

This table letter informs employers how much National Insurance a person needs to contribute.

To allow umbrella employers to manage their payroll, they must calculate the National Insurance they and you need to contribute. They use a table letter to do this.

Most employees will have the category letter A pay slip for 2021/22. Employer National Insurance and Employees National Insurance are charged for amounts exceeding the primary and secondary thresholds of 13.8% and 12.2%, respectively. Employees are limited to 2% on earnings above the upper earnings limit.

National insurance contributions will rise by 1.25% from 6 April 2022 to 7 April 2023. These funds will go towards the NHS and other social services in the UK.

The following:

* Class 1 (paid to employees)

* Class 4 (paid to self-employed).

* Secondary Class 1, 1A, and 1B (paid to employers)

If you are older than the State Pension age, the increase will not be applicable.

These are the full National Insurance table letter category categories for 2022/23:

Contributions:

|

Letter |

Earnings below LEL |

Earnings at or above LEL up to and including PT |

Earnings above PT up to and including UEL |

Balance of earnings above UEL |

|

A |

NIL |

0% |

13.25% |

3.25% |

|

B |

NIL |

0% |

7.10% |

3.25% |

|

C |

NIL |

NIL |

NIL |

NIL |

|

F |

NIL |

0% |

13.25% |

3.25% |

|

H |

NIL |

0% |

13.25% |

3.25% |

|

I |

NIL |

0% |

7.10% |

3.25% |

|

J |

NIL |

0% |

3.25% |

3.25% |

|

L |

NIL |

0% |

3.25% |

3.25% |

|

M |

NIL |

0% |

13.25% |

3.25% |

|

S |

NIL |

NIL |

NIL |

NIL |

|

V |

NIL |

0% |

13.25% |

3.25% |

|

Z |

NIL |

0% |

3.25% |

3.25% |

Employers Contributions

|

Letter |

Earnings below LEL |

Earnings at or above LEL up to and including ST |

Earnings above ST up to and including FUST |

Earnings above FUST up to and including UST/AUST/VUST |

Balance of earnings above UST/AUST/VUST |

|

A |

NIL |

0% |

15.05% |

15.05% |

15.05% |

|

B |

NIL |

0% |

15.05% |

15.05% |

15.05% |

|

C |

NIL |

0% |

15.05% |

15.05% |

15.05% |

|

F |

NIL |

0% |

0% |

15.05% |

15.05% |

|

H |

NIL |

0% |

0% |

0% |

15.05% |

|

I |

NIL |

0% |

0% |

15.05% |

15.05% |

|

J |

NIL |

0% |

15.05% |

15.05% |

15.05% |

|

L |

NIL |

0% |

0% |

15.05% |

15.05% |

|

M |

NIL |

0% |

0% |

0% |

15.05% |

|

S |

NIL |

0% |

0% |

15.05% |

15.05% |

|

V |

NIL |

0% |

0% |

0% |

15.05% |

|

Z |

NIL |

0% |

0% |

0% |

15.05% |

Glossary

LEL – Lower Earnings Limited

PT – Primary Threshold

ST – Secondary Threshold

FUST – Freeport Upper Threshold

UEL – Upper Earnings Limit

UST – Upper Secondary Threshold

AUST – Apprentice Upper Secondary Threshold

VUST – Veterans Upper Secondary Threshold

NI Category Letters

A – All not covered by another category

B – Married woman and widows entitled to pay reduced NI

C – Employees over state pension age

F – Freeport standard

H – Apprentice Under 25

I – Freeport married woman’s reduced rate election (MWRRE)

J – Deferment

L – Freeport deferment

M – Under 21

S – Freeport over state pension age

V – Veterans standard

Z – Under 21 deferment